We all know that when news hit the market that it can move quite a lot.

This move doesn’t happen instantaneously though, it often takes at least a few seconds for the new information to get priced into the market.

It also doesn’t happen at the same speed on all markets. More sophisticated markets like equities will price the information in quicker than the crypto market.

We can use this fact to do a lead-lag trade!

Latency Arbitrage - How to start

In the previous article, we looked at how to properly do DCA (Dollar-Cost-Averaging) by quantifying different approaches and seeing how they impact returns, variance and downside variance. In this article, we are gonna look at one of my favorite HFT trades: Lead Lag Arbitrage or Latency Arbitrage.

Table of Content

News that impact Crypto

Equities vs Bitcoin

Bitcoin vs Shitcoins and Cross Exchange Trading

Final Remarks

News that impact Crypto

Generally speaking, all news that affect the US economy and move the US stock market will also move Bitcoin in the same direction.

Some of those scheduled events are:

Consumer Price Index (CPI):

Average change in prices paid by consumers for goods and services over a month.

This is used as a measure of inflation / deflation.

The Producer Price Index (PPI) works in a similar way, it measures the change in prices domestic producers receive.

They will naturally look pretty similar.

Unemployment Claims:

Like the name implies this is the number of new unemployment claims over the past week.

It’s used as a measure of the health of an economy.

Gross Domestic Product (GDP):

Total value of all goods and services produced within a country's borders over 3 months.

Real GDP takes into account inflation and is usually prefered.

It’s used as a measure of the size of an economy and its health.

Retail Sales:

This measures how much money is spent on food, clothing and other retail sales over a month. It’s used to measure consumer demand.

Federal Open Market Committee (FOMC) meetings:

Those meetings happen 8 times a year and are used to discuss monetary policy changes, announcing interest rate changes, adjusting the money supply etc.

It’s one of the most important scheduled economic events.

Non-Farm Payrolls:

Change in the number of people employed during the previous month, excluding the farming industry. It’s used to measure the health of the economy.

There are of course of many many more economic events that move markets but those are some of the most important ones.

Equities vs Bitcoin

It’s no secret that equities are far more efficient than the crypto market and that the infrastructure is much more sophisticated.

We can therefore propose the following strategy:

As soon as news drop wait for a change in price in an ETF that tracks the S&P500, for example the SPY.

As soon as price moves in some direction which will probably happan within a second you open a position in the same direction for BTC, trying to frontrun the news flow.

You can close your position based on a couple of rules which we will discuss in the next section.

This approach isn’t very suitable for retail traders since it can be pretty difficult to get a fast real time price feed cheaply.

Bitcoin vs Shitcoins and Cross Exchange Trading

Instead retail traders can use the price of major currencies like Bitcoin on major exchanges like Binance to lead prices of smaller coins on smaller exchanges.

Let’s look at an example:

On may 14th at 12:30pm UTC we’ve had PPI:

Here is what the secondly chart for BTC on Binance looked like:

and here is a smaller coin, ALGO:

As you can see the initial move happened quicker on BTC than it did on the altcoin.

Now the entries on this trade are simple but the exits can be a little more tricky, here are some approaches:

Volume based:

You simply exit when you deem that volume is low.

Volume will usually follow a shape that looks roughly like this during those types of events:

You can’t simply close the position if volume returns to the levels before the event because it tends to stay elevated for a while which you can see nicely in the BTC example:

Instead you could put a moving average on the volume and exit if volume goes below its moving average (and stays there for a while).

when you do this I would also recommend looking at the volume of BTC instead of the altcoin that you are trading since BTC is gonna be much more liquid and the volume is gonna be smoother.

Price-based:

There are a couple of price based approaches. The first one is trading this like you would trade momentum or trend-following, if price reverses you exit the trade.

This can once again be done via a moving average but you can of course use more sophisticated methods.

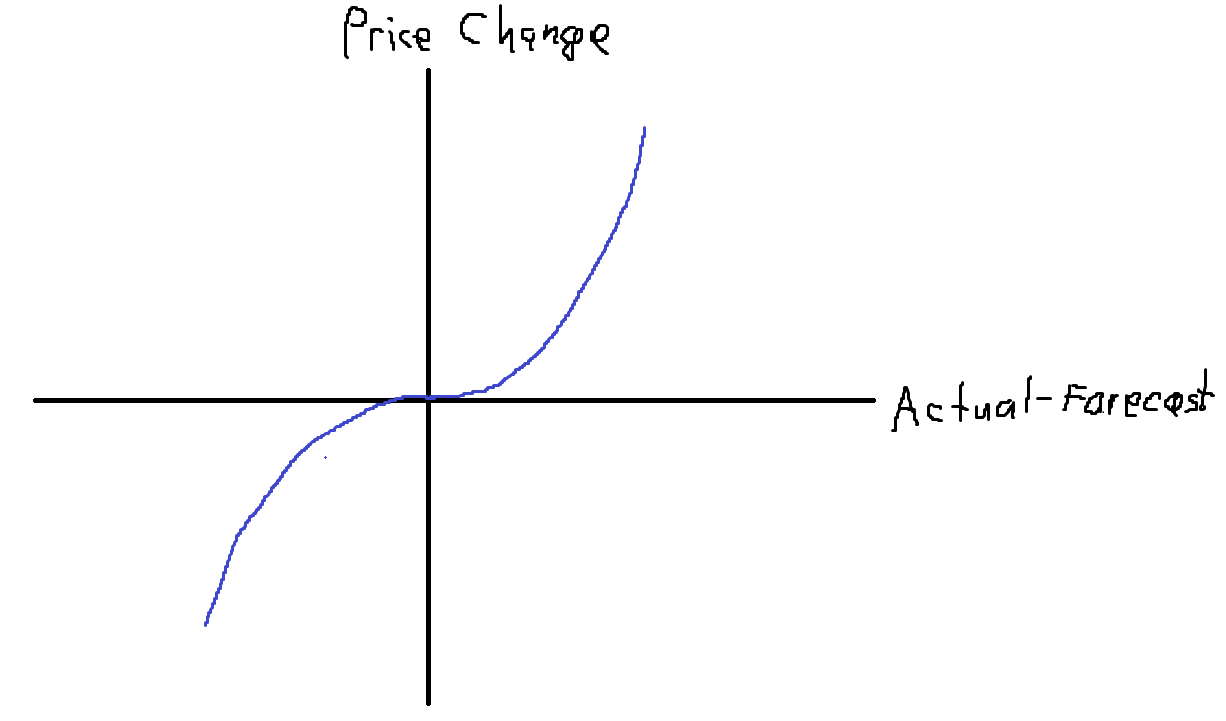

Another price based method is a price-impact model using the economic data.

You could take into account the forecast and the actual numbers and regress those historically against the price impact.

You would build a model like that for each of the economic events, one could look something like this:

You then exit once price reaches your predicted new price.

Note: This is a very simple model, in reality those can become very very sophisticated.

Time-based:

The least sophisticated but simplest and quickest to implement method is just exiting after some period of time.

The bigger the difference between the actual numbers and the predicted numbers are the longer the trades will last on average (you usually want to use the mode rather than the mean is such scenarios), you can once again regress those historically:

Final Remarks

With this trade you obviously want to have good infrastructure with the ability to trade quickly. While this isn’t super easy it’s definitely possible, there are some nice examples of people on twitter doing just that!

Another thing to consider is that spreads will widen during those events because MMs don’t want to quote tight. This can make it difficult to get filled at a good price and good size. This makes the trade more lucrative for smaller traders who don’t impact the book much anyway though!