Volatility Forecasting from High-Frequency Quotes

and the pitfalls to look out for.

Happy New Year, dear reader!

Getting access to high-frequency data in crypto is easier than in any other market. Even if you don’t want to spend a couple of hundred or thousand dollars on historical data, you can set up data collection yourself pretty cost-efficiently and reliably.

We show how to use this high-frequency data to get better forecasts of volatility, compare different volatility forecasting models, and show how to properly diagnose a volatility forecasting model.

Table of Contents

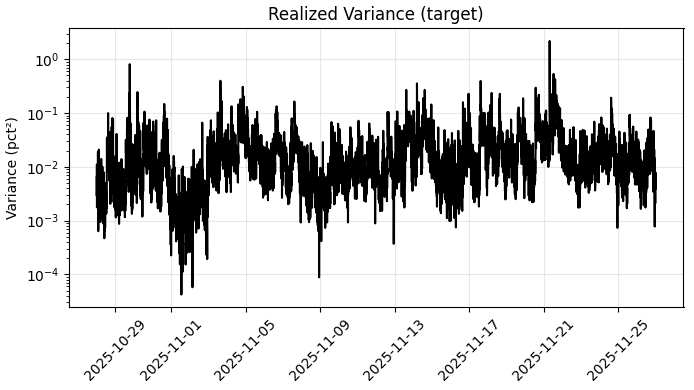

Realised Variance from High-Frequency Returns — Our Forecast Target

Range-based Variance Estimators — Sometimes, Less is More

Sampling Frequency — The Problem with High Frequency Data

Rolling Averages and EWMA — Baseline Variance Forecasts

Tuning EWMA via QLIKE — A Proper Scoring Rule for Variance

GARCH Family — Conditional Heteroskedasticity Models

Stochastic Volatility and Kalman Filters — How to Actually Use a Kalman Filter

Volatility Forecast Diagnostics — What Model is The Best?

Final Remarks — Conclusion, Code, and Discord