Quantitative Finance - How to Start

A full roadmap for how to get started in quant finance.

Dreaming of Becoming a Quantitative Researcher or Trader? Start Here!

Have you ever aspired to become a quantitative researcher or trader but felt overwhelmed by the sheer number of topics to learn or the secrecy surrounding the quant finance industry? You’re not alone, and this guide is here to help.

This comprehensive guide is designed to help you get started in quantitative finance as quickly and efficiently as possible. Unlike other resources that list endless books or complex topics, this guide focuses on the essential knowledge you need to kickstart your journey—without wasting a year on unnecessary details.

Table of Content

Python & Rust

Mathematics, Statistics & Probability Theory

Optimization

Machine Learning

Numerical Methods

Derivatives and Pricing

Portfolio and Risk Management

Trading and Strategies

HFT & Market Making

Data & APIs

Projects

Now what? - Final Remarks

Python & Rust

Before you can get started with actually learning quant specific things you need a few prerequisites. Being able to code is one of them.

For most people starting out with just Python (or a similar high level language that lets you quickly produce code) will be enough.

Learning lower level languages like Rust only really becomes necessary if you are interested in things like high frequency trading and infrastructure.

I’ve chosen Rust due to its large increase in popularity in the digital asset space but you could also learn a different low level language like C++.

If you already have beginner level skills you can skip this section.

What I recommend people do is first learn the very basics of a programming language (which won’t take more than an hour) and then just start doing small projects with it and learning on the go by looking up how to code something whenever you get stuck.

If you have no coding experience here are some resources to get you started:

Python

https://docs.python.org/3/ (Official python docs, can look up EVERYTHING here)

When you use python for quant finance you will more than likely use the following 3 libraries all the time:

numpy (Fast library for working with arrays and matrices)

pandas (Data manipulation and analysis, Dataframe data structure)

matplotlib (Plotting)

Here are some useful tutorials for those:

with their official documentations:

https://pandas.pydata.org/docs/

https://matplotlib.org/stable/index.html

Rust

I couldn’t do a better job at telling you how to get started in rust than the official rust website so head over there to check out their book.

https://doc.rust-lang.org/book/title-page.html

Mathematics, Statistics & Probability Theory

Similar to coding you need a few math and stats prerequisites to get stared in quant.

There is this rumor that you need to have a PhD level understanding of math to be able to do quant research but in reality a first semester college level of math will be enough for the vast majority of tasks.

Exceptions are if you want to go the academic research route or you’re doing something that requires stochastic calculus like derivatives pricing.

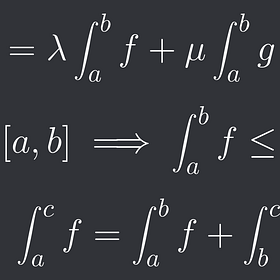

I have 2 articles on math for quant finance:

Math for Quant Finance (Calculus)

I get a lot of people asking what math they should learn for quant finance so I’m gonna summarize all of the most common and useful math that I use in quant finance in a series of articles!

Math for Quant Finance (Linear Algebra)

Linear Algebra covers linear equations, linear maps, matrices and vectors.

If you want to gain access to those here is a 10% discount code:

https://www.vertoxquant.com/62375e34

Calculus and Linear Algebra will be the most important pure math disciplines you need to understand.

Now you don’t need to take one of those whole MIT courses that you see on youtube because let’s be honest, who will actually stick all the way through?

Instead just learn the basics of the topics that I mention in the above 2 posts.

For statistics I can really recommend the following 2 youtubers / playlists:

https://www.youtube.com/playlist?list=PL0o_zxa4K1BVsziIRdfv4Hl4UIqDZhXWV

https://www.youtube.com/playlist?list=PLblh5JKOoLUK0FLuzwntyYI10UQFUhsY9

If you want to learn mathematics, probability theory etc. more in-depth I recommend the following channel:

https://www.youtube.com/@brightsideofmaths

It has a bunch of really useful playlist.

Optimization

Now that we have the prerequisites down we can start learning about the most important algorithms, models and techniques used in quant finance.

We start of with optimization. You can probably imagine that finance involves a lot of optimization. We may for example want to optimize the expected value of a portfolio but want variance to stay below a certain threshold (This is part of portfolio management and will be covered later).

Optimization is an absolutely huge field, including:

Convex Optimization

Linear Programming

Semidefinite Programming

Optimal Control

and many more fields that you may have heard of before.

For an overview of optimization subfields the wikipedia page on mathematical optimization is actually really nice.

A good introductory playlist is the following:

https://www.youtube.com/playlist?list=PLYaCCH_3sfS333yOo5wGlq8lFnLKzf17P

The main area in optimization is convex optimization. By far my favorite resource is the book “Convex Optimization” by Stephen Boyd: https://a.co/d/8Q84mVX

Numerical Optimization techniques will be discussed in the “Numerical Methods” section.

Machine Learning

When I talk about machine learning I don’t just mean things like Neural Networks but in general every model that you fit to make predictions.

The most important such models are by far regression models so that is what you should get familiar with first:

https://www.analyticsvidhya.com/blog/2022/01/different-types-of-regression-models/

All those models are really simple, you can just go on youtube and search up all of those models to learn how they work.

I can again recommend channels like StatQuest for that, he explains topics like that in a really simple to understand manner.

One really amazing book on machine learning is “The Hundred-Page Machine Learning Book” by Andriy Burkov.

You can check it out on their website: https://themlbook.com/

It’s short but summarizing so much that you need to know in a really nice way.

Topics included are clustering, regulerization, deep learning, kernels and many more.

Numerical Methods

The last thing you should learn about before finally jumping into the finance part.

We can’t always find exact solutions to problems, be it in optimization or pricing derivatives or whatever.

Numerical Methods are incredibly powerful as they allow us to obtain approximate solutions to problems, often in a really simple manner (The caveat is that they require a lot more computational time).

Let’s go step-by-step over what kind of numerical methods exist and resources for them:

Root Finding

The goal with root finding algorithms is to find roots of functions f(x) = 0.

https://www.youtube.com/playlist?list=PLb0Tx2oJWuYIpNE23qYHGQD42TIR3ThNz

Optimization

The goal here is to find minimums / maximums of functions. The most common type of algorithm are descent algorithms like gradient descent:

Integration

Those are used to approximate integrals. Sometimes integrals are difficult or even impossible to solve analytically.

Differentiation

If we can integrate numerically then we can also differentiate numerically.

Interpolation and Approximation

Used for curve fitting and smoothing. We can also extrapolate to make predictions about data points outside of the data we already have.

and many more topics.

The following 2 playlist go into a lot more detail:

https://www.youtube.com/playlist?list=PLDea8VeK4MUTppAXQzHBNz3KiyEd9SQms

https://www.youtube.com/playlist?list=PLkZjai-2Jcxn35XnijUtqqEg0Wi5Sn8ab

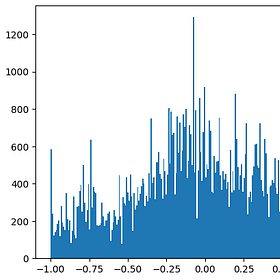

Another really important numerical method for quants is Monte Carlo Simulation that I’ve used in the following article:

Simulating Price Movement for Monte Carlo Methods

There are a lot of instances where you want to be able to generate a lot of price paths for some asset. Getting statistics like CVAR, pricing derivatives, portfolio optimization and more.

As you can see in the article it’s used mostly for derivatives pricing and portfolio and risk management.

https://www.youtube.com/playlist?list=PLQVvvaa0QuDdhOnp-FnVStDsALpYk2hk0

Derivatives and Pricing

The industry standard for learning about all sorts of derivatives is Hulls book “Options, Futures, and Other Derivatives“ that almost everyone in the industry has read. https://amzn.eu/d/2qoFihe.

If you want to learn specifically about options then there is another industry standard book called “Option Volatility and Pricing” by Natenberg. https://amzn.eu/d/b1PC5eL.

Those books contain a LOT of content. You don’t need to read them front to back entirely. I would read the first few chapters fully and then just skim over the rest of the books and come back to them whenever you need.

Portfolio and Risk Management

This part is overlooked by a lot of beginners even though it is crucially important.

Portfolio and Risk Management isn’t just about allocating the same amount of money to every startegy / asset and risking x% per trade.

My 2 favorite books are “Quantitative Portfolio Management” by Michael Isichenko:

https://a.co/d/83bG7Ih

And “Advanced Portfolio Management” by Giuseppe A. Paleologo:

https://a.co/d/c1GBktX

If you just want to learn about portfolio management and risk management then you can start with chapter 3 of the first book and the entirety of the second book (The first 2 chapters are pretty interesting too so you can read those as well if you want).

Trading and Strategies

You should now have a basic understanding of finance and portfolio management.

That’s nice and all but how do you actually start outperforming now? Might as well just invest in some ETFs with all the knowledge you have so far.

You need to find alphas, inefficiencies and risk premia in the market.

Some examples are the following:

Funding Arbitrage - How to Start

There is a unique type of futures contract in the crypto world, perpetual futures.

A strategy I used to run live

I keep talking about how much I love event based alphas but sometimes people don’t exactly know what I’m talking about and assume I’m talking about news trading so I’m gonna lay my cards on the table today and tell you about one strategy that I actually used to run.

To learn about what kinds of alphas and strategies exist I would first read the 3 book series by Ernest P. Chan:

Quantitative Trading: https://amzn.eu/d/9A90AoY

Algorithmic Trading: https://amzn.eu/d/1I0TzQk

Machine Trading: https://amzn.eu/d/6Cj2pcn

And then the books written by Euan Sinclair:

Volatility Trading: https://amzn.eu/d/7bd0aI7

Option Trading: https://amzn.eu/d/5lqfQmA

Positional Option Trading: https://amzn.eu/d/hUb6TfQ

Retail Options Trading: https://amzn.eu/d/gqEB42c (I haven’t read this one myself but a lot of colleagues recommend it and I trust the author!)

Lastly I would read the following pdf on volatility trading: https://www.trading-volatility.com/Trading-Volatility.pdf

Will you gain a ton of edge and some super profitable strategies? Probably not. That’s what doing your own research and thinking is for. The books will show you what event exists in the space though and will give you a ton of ideas to think about.

HFT & Market Making

High frequency stuff is usually a lot more sophisticated than mid and low frequency stuff that we’ve learned so far. It’s also what most trading firms and researchers put their main focus on (especially Market Making).

If you haven’t learned any low level language like Rust or C++ yet then now is the time, high level languages like python won’t cut it anymore since they aren’t fast enough.

The first thing I would do is read “High-Frequency Trading: A Practical Guide to Algorithmic Strategies” to learn the basics: https://amzn.eu/d/baVeRg3

For an introduction into market making specifically you can read my articles:

Market Making - How to start

In the previous article we looked at TWAP and VWAP and learned why those 2 indicators are extremely important in financial markets.

Other than that I would first read the following research paper by Avellaneda & Stoikov: https://www.researchgate.net/publication/24086205_High_Frequency_Trading_in_a_Limit_Order_Book

It’s the most popular paper in all of high frequency trading and will give you a general idea for how market making models work.

The thing with high frequency trading is that you need to get your hands dirty and there is not really a way around it. Great market making systems are built from thousands of hours of work with many many alphas used to estimate fair price, volatility forecasting and a bunch of other stuff that we’ve already learned.

So to everyone who wants to get started with market making I would suggest to pick a small uncompetitive exchange and just start playing around and doing research.

Come up with one model (or implement an existing one like A&S), see where you lose money or face other problems and improve the model iteratively.

Something people like to use is https://hummingbot.org/ but I recommend building out your own infrastructure as that will be a lot more flexible and (eventually after a lot of work) more sophisticated.

When building out infrastructure I would first recommend building out an event-based backtester which I explain in the following (free) article:

Event-Driven Backtester in Python

In the previous PyNL article we’ve coded up a bunch of different risk metrics and plots.

After that you would start building out your trading infrastructure.

I like the following articles on that topic:

https://medium.com/prooftrading/proof-engineering-the-algorithmic-trading-platform-b9c2f195433d#d545

https://blog.quantinsti.com/automated-trading-system/

and the following video:

Data and APIs

Without data and without connecting to exchanges you won’t be able to do anything.

The nice thing is that most crypto exchanges provide some historical data for free but if you want to have high frequency data like trades, quotes, book updates, etc. then you will need a data provider.

The standard in crypto is Tardis and its what I’ve used for years and can recommend as well.

Crypto exchanges also provide pretty nice API documentation where you can look up everything you need.

https://developers.binance.com/docs/binance-spot-api-docs/rest-api

https://bybit-exchange.github.io/docs/v5/intro

https://www.okx.com/docs-v5/en/

Other than having data you should also know how to handle data that could contain missing or even wrong data points:

Projects

There are 3 reasons to work on projects.

To make money

To impress hirers

To practice

In the beginning the practice part is the most important one, you won’t start building a successful market making business in your first week of trading.

If you go down the route of an independant trader or already work at a firm then you’re doing it for money.

If you already have a good amount of experience and are looking for a job you’d do some projects to impress hirers. This could even mean running a trading business with a few hundred or thousand bucks, something that won’t make a lot of money but will show hirers that you know what you are doing.

I present some example projects in the following tweet:

https://x.com/Vertox_DF/status/1810866784787955997

we also build an entire project in the following 2 series of articles:

From Idea to Live Trading

Triangular Arbitrage Scanner

You should build the project that *you* are interested in and are learning about though.

Currently learning about option pricing? Why not build an option pricer!

Learning about funding arbitrage? Get a funding arb strategy live and running!

Now what? - Final Remarks

Congrats for making it this far!

At this point you should have a really good base to explore the field of quant finance.

What you should do now? Whatever you feel like!

We’ve only learned the very basics of each subject in this article and the amount of stuff you can learn that’s useful as a quant would take multiple lifetimes to learn.

Just pick whatever topic you are most interested in or that’s currently the most useful for you and start researching it!